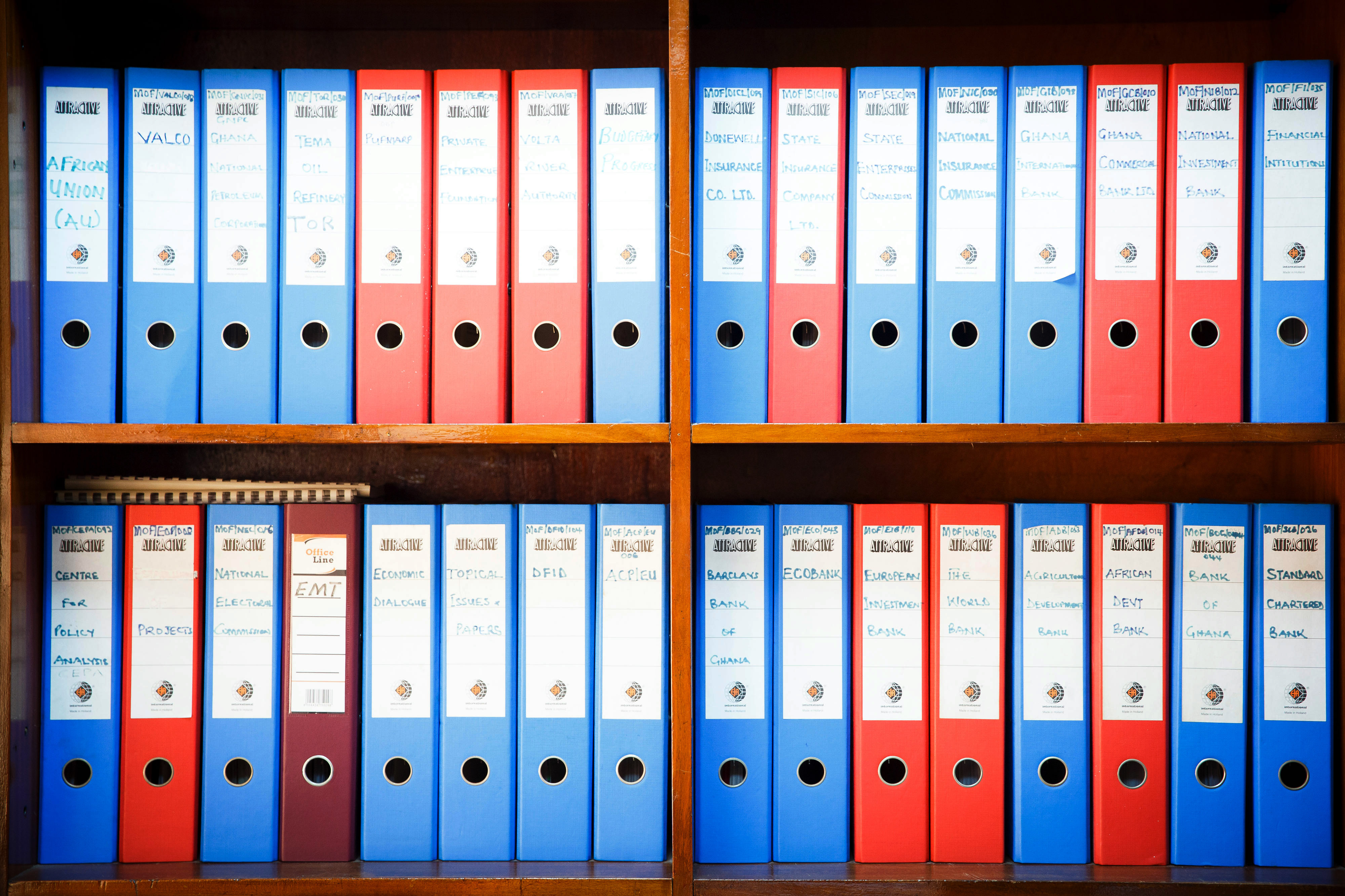

Employee at the Ministry of Finance in Accra, Ghana

Copyright© Ute Grabowsky/photothek.net

Good financial governance

The Federal Ministry for Economic Cooperation and Development (BMZ) takes a holistic, values-based approach to promoting good financial governance. This is rooted in the belief that a transparent and legally sound public finance system is inextricably linked with other principles of good governance. These include the rule of law, respect for human rights, the advancement of a social market economy, and the political participation of all segments of the population.

Good financial governance is crucial to overcoming the current multidimensional crises, which require extensive funds and, at the same time, require those funds to be implemented quickly yet responsibly.

The management of public finances thus cannot be viewed in isolation, or from a purely technical perspective. Financial reforms can only be successful if they take a country’s political, economic, legal, social, cultural and historical context into account.

Germany’s areas of activity

When it comes to choosing its areas of action, German development cooperation is guided by the needs and situation of each individual partner country. Key areas are:

- Tax policy and tax administration reform

(mobilising domestic revenue, improving efficiency and service focus, promoting fair taxation) - Public budget

(advice on planning, setup, implementation and auditing, involving civil society, cross-regional sharing of knowledge and experience) - Financial controlling

(increasing the efficiency and independence of national supreme audit institutions through organisational advice and infrastructure development) - Public procurement

(increasing cost efficiency and transparency, aligning the award of public contracts with social and environmental principles) - Fiscal decentralisation

(improving financial management at provincial and municipal level, appropriate distribution of public revenue between levels of government according to the division of competences) - Debt management

(cooperation with the World Bank, the International Monetary Fund and the UN Conference on Trade and Development)

In order to offer the most practical advice possible, where necessary the BMZ draws on the expertise of German financial institutions (supreme audit authorities, tax administrations, finance ministries). Support from experts is also provided via the Senior Expert Service (SES).

International Tax Compact

As part of the second global conference on financing for development in Doha in 2008, the BMZ initiated the foundation of the International Tax Compact (External link) (ITC). This platform for dialogue and action is open to all developing countries and emerging economies and international and regional organisations that engage with development policy and taxation.

The ITC aims to promote fair, efficient and transparent tax systems that contribute to sustainable development.

- It acts as a link between initiatives it supports and other organisations that are active in the area of taxation and development.

- It offers impetus and shares established initiatives and approaches with its members.

- In addition, the ITC provides secretarial services for international initiatives and networks it supports.

The ITC secretarial services – which are based in Bonn – are funded by the BMZ, and currently facilitate the secretariats of the Addis Tax Initiative (External link) and the Network of Tax Organisations (External link).

International cooperation

Germany also promotes good financial governance via European and multilateral institutions. The BMZ is striving to coordinate German development projects more closely with EU Commission programmes, for example. The aim is to incorporate the values represented in German development cooperation – such as transparency, accountability and public participation – more thoroughly into EU programmes.

When it comes to public financial management and debt management, key partners in Germany’s development policy include the International Monetary Fund (IMF), the World Bank and the Organisation for Economic Co-operation and Development (OECD).

Germany is a major contributor to the IMF trust fund supporting tax policy and administration in developing countries. Germany also promotes fair, transparent public procurement processes in partner countries via the MAPS initiative (External link) (Methodology for Assessing Procurement Systems). In addition, the federal government supports the development and distribution of the Tax Administration Diagnostic Assessment Tool (TADAT (External link)), which assesses the strengths and weaknesses of tax administrations.

As at: 27/11/2023