Meeting room of the international donor conference of the Green Climate Fund, hosted by the German government in Berlin on 20 November 2014.

Copyright© Ralf Rühmeier

Climate change and development Climate finance: Germany remains a reliable partner

In its development policy, the German government uses public funding to support the implementation of the Paris Agreement (External link). This is a shared responsibility which requires countries across the world to take action – including through contributions from developing countries and emerging economies and through the participation of the private sector.

Only if developing countries and emerging economies, too, undertake ambitious efforts to reduce greenhouse gas emissions and adapt to the consequences of climate change will it still be possible to achieve climate neutrality and climate resilience in the course of the century. Supporting thes countries' efforts is not just an expression of global responsibility. It also contributes to long-term stability, security and economic cooperation – which benefits Germany, too.

As early as in 2009, the world's industrialised countries decided at the Copenhagen climate summit to provide and/or mobilise, from 2020, an annual 100 billion US dollars for climate change mitigation and adaptation in developing countries. At the 2015 Paris climate conference, it was agreed to extend this goal to 2025. According to OECD figures, the target was reached for the first time in 2022. Then at the climate conference in Glasgow in 2021, the industrialised countries pledged to at least double their adaptation finance for developing countries from 2019 levels by 2025, in order to help achieve a balance between adaptation and mitigation finance.

Ambitious new funding target adopted

A New Collective Quantified Goal (NCQG) on climate finance has been adopted for the period after 2025. It exceeds 100 billion US dollars and takes special account of developing countries' needs and priorities.

Following intensive negotiations at COP29 in Baku in November 2024, the Conference of the Parties adopted a new core goal of at least 300 billion US dollars a year for the period up to 2035. From 2026, this core goal will replace the old 100 billion dollar target. The industrialised countries will continue to take the lead on providing funding. However, countries in the Global South with relatively high income levels are to contribute as well.

This change in the donor base constitutes a paradigm shift. Multilateral development banks play an important role in this context. And for the first time, developing countries' own climate-related contributions can be counted on a voluntary basis. The NCQG also requires contributors to triple annual outflows from climate funds such as the Green Climate Fund from 2022 levels by 2030. This shows the growing importance of multilateral climate finance.

In addition to the core goal of at least 300 billion US dollars a year, the Baku Conference of the Parties also agreed to work towards a global funding goal of 1.3 trillion US dollars per year by 2035. This goal is to be funded mainly from private sources. Options for implementation are currently being drafted and will be presented at COP30 in Belém, Brazil, in November 2025.

In order to achieve the necessary changes, a full transformation of the global financial system will be needed. All finance flows must become consistent with climate neutrality and resilience. This includes private investment and foreign direct investment. The parties to the Paris Agreement have all committed themselves to this (Article 2.1(c)).

Germany's contribution to international climate finance

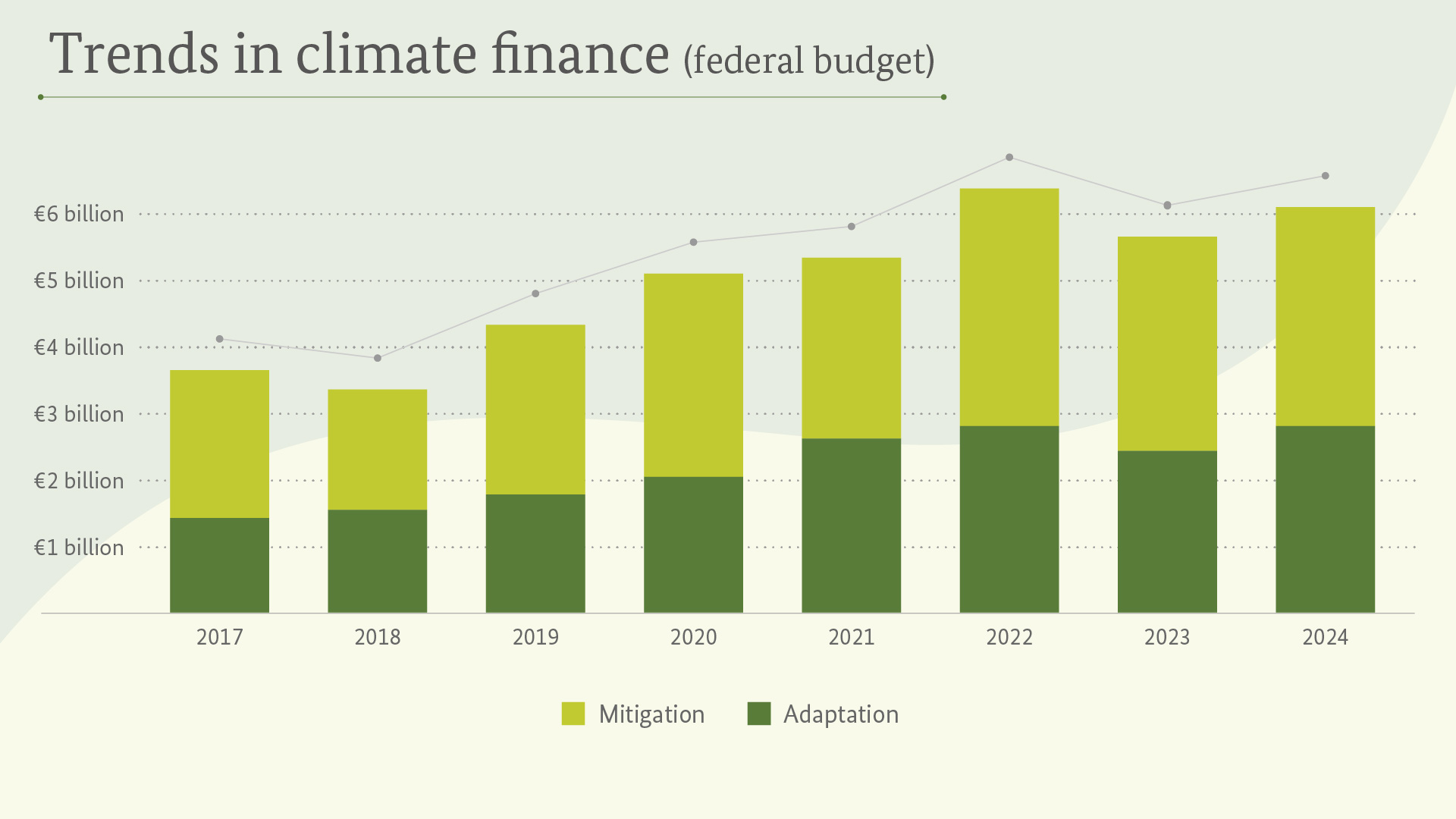

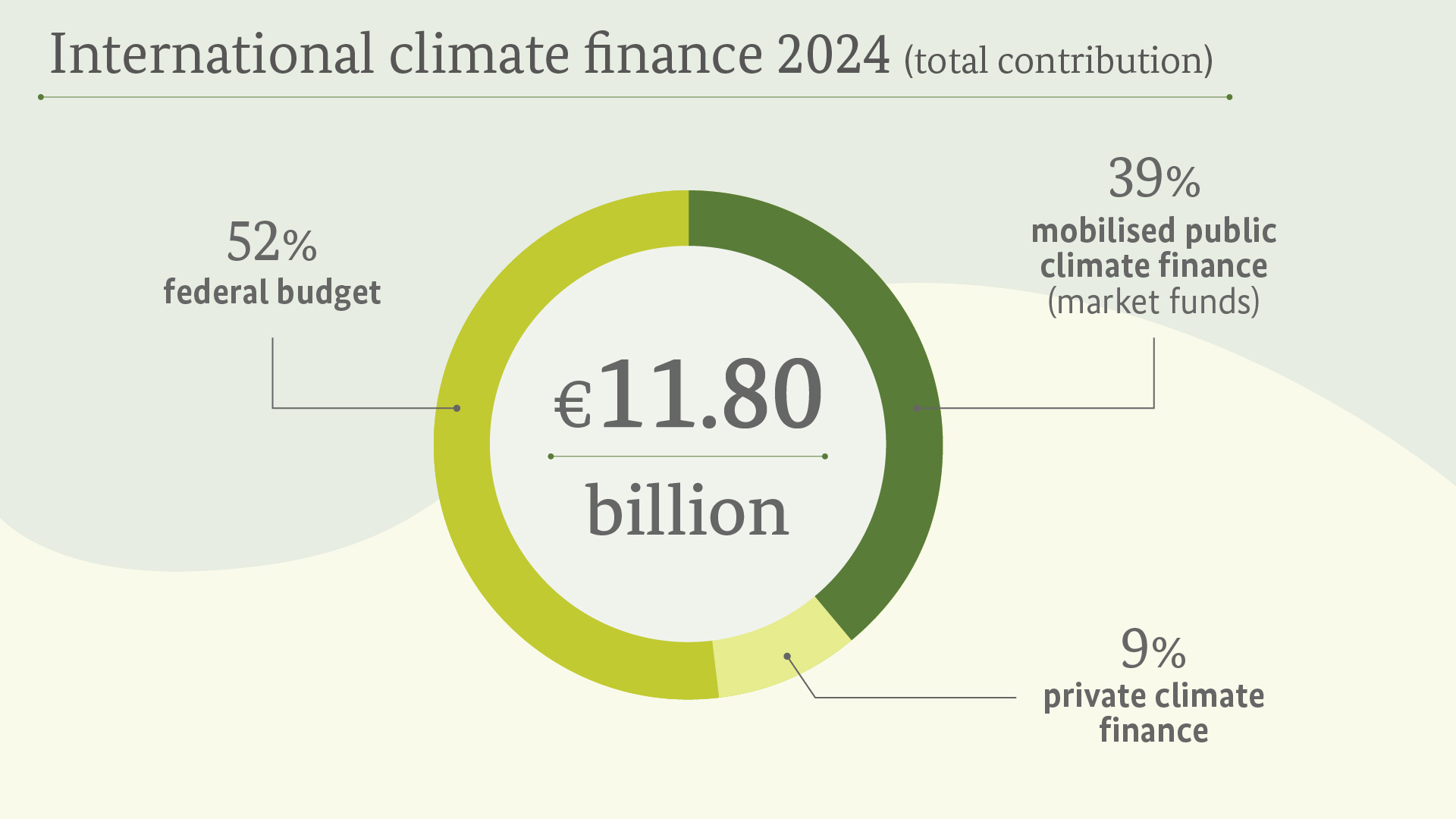

Germany has significantly increased its contributions to international climate finance in recent years. In

2024, Germany's contributions totalled 11.8 billion euros. Germany has thus contributed its fair share

to the global 100 billion dollar target, and it has created sustained opportunities for its partner countries.

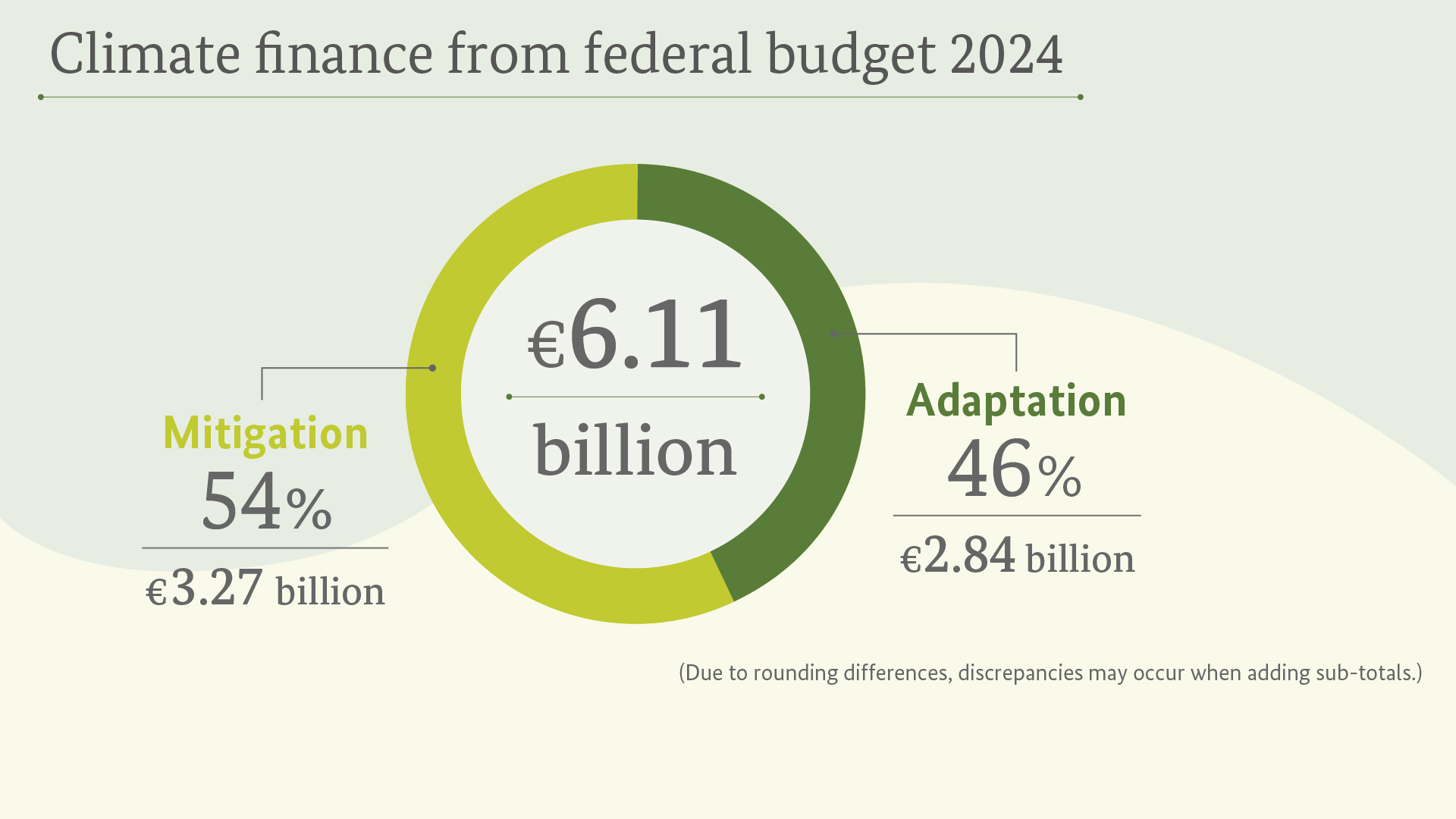

Of that total, some 6.11 billion euros was official budget funding from the German government for

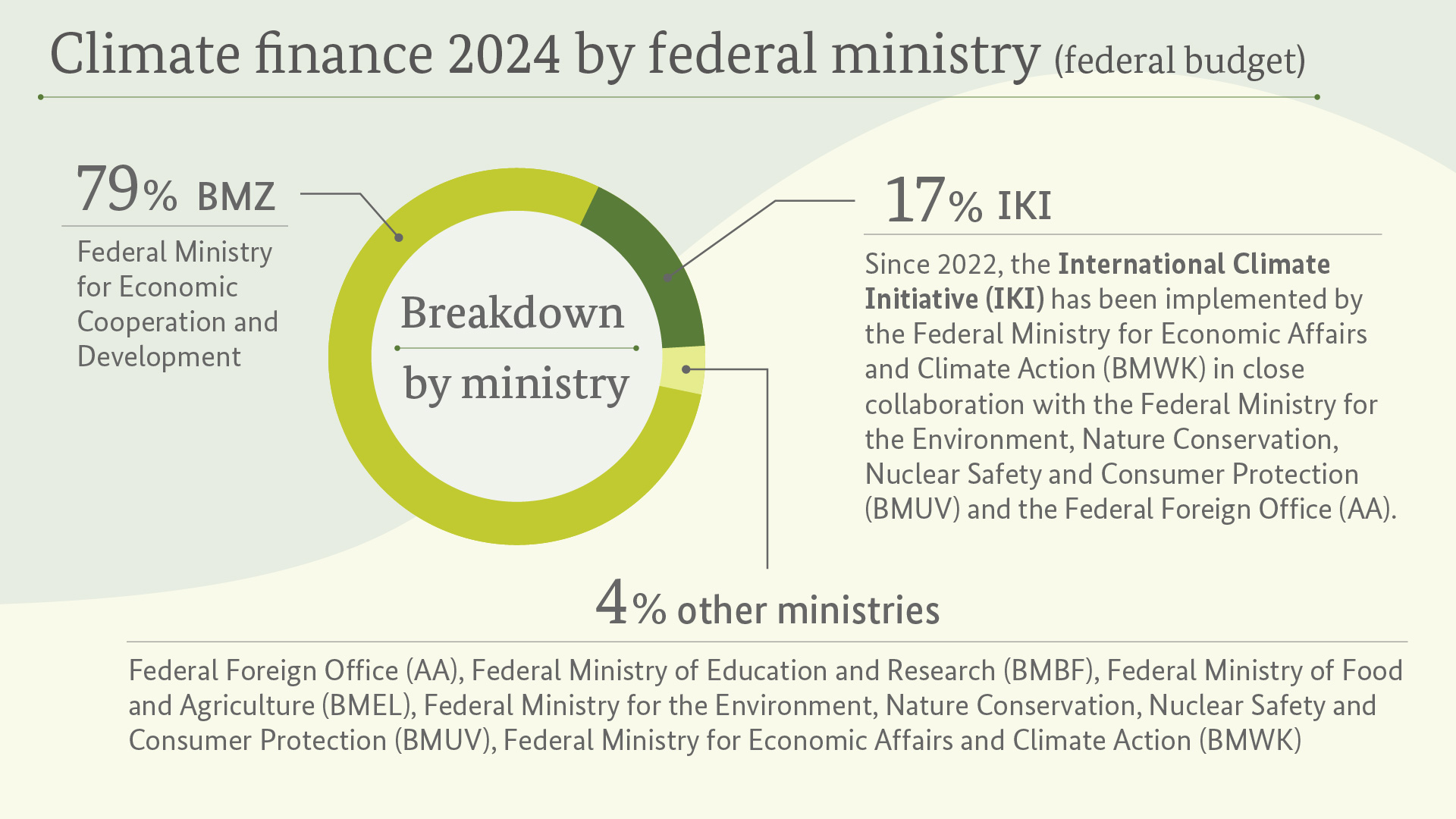

climate change mitigation and adaptation. This also includes grant equivalents from KfW development loans. Of the budget funds, 79 per cent came from the budget of the German Development Ministry

(BMZ).

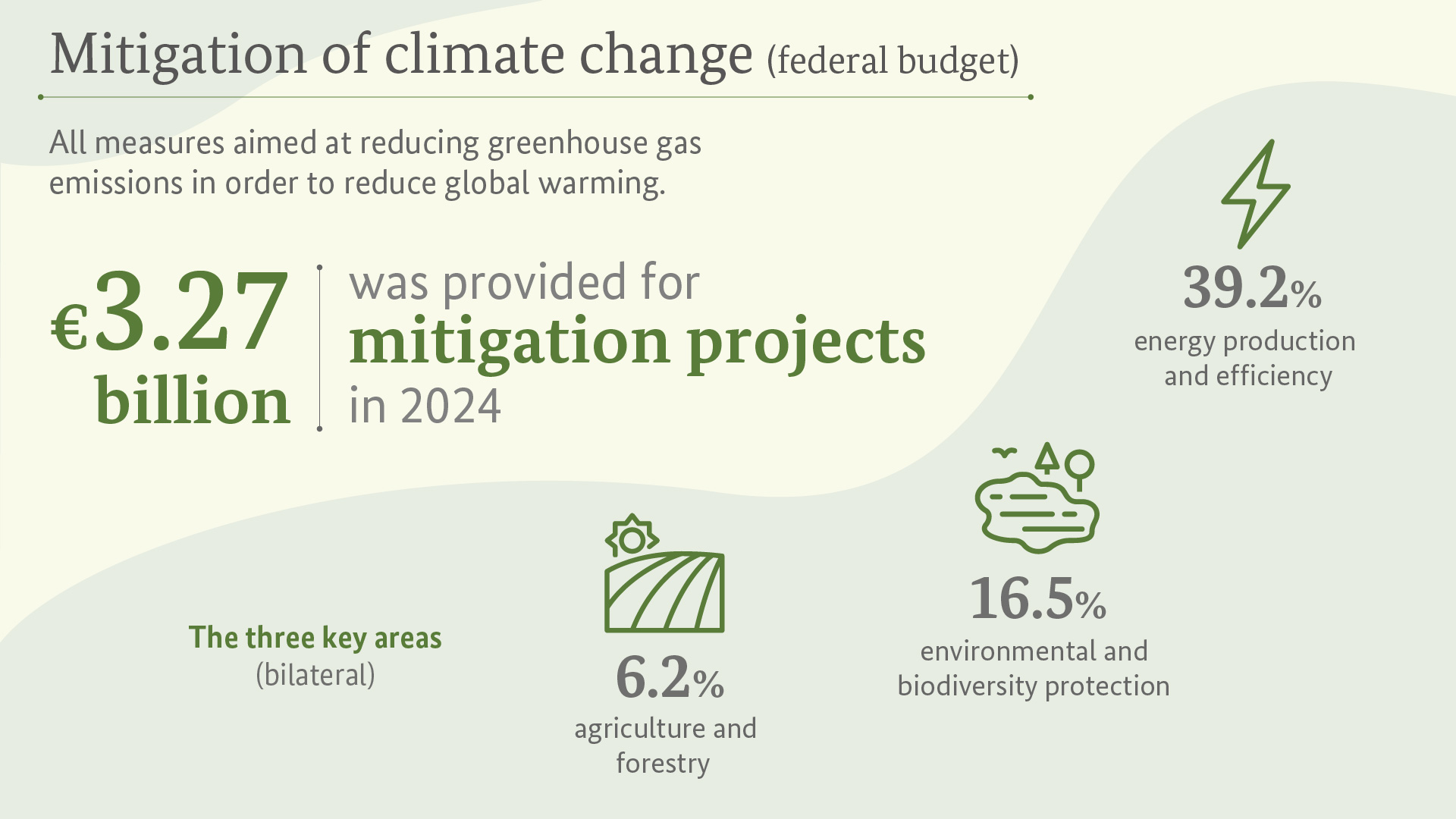

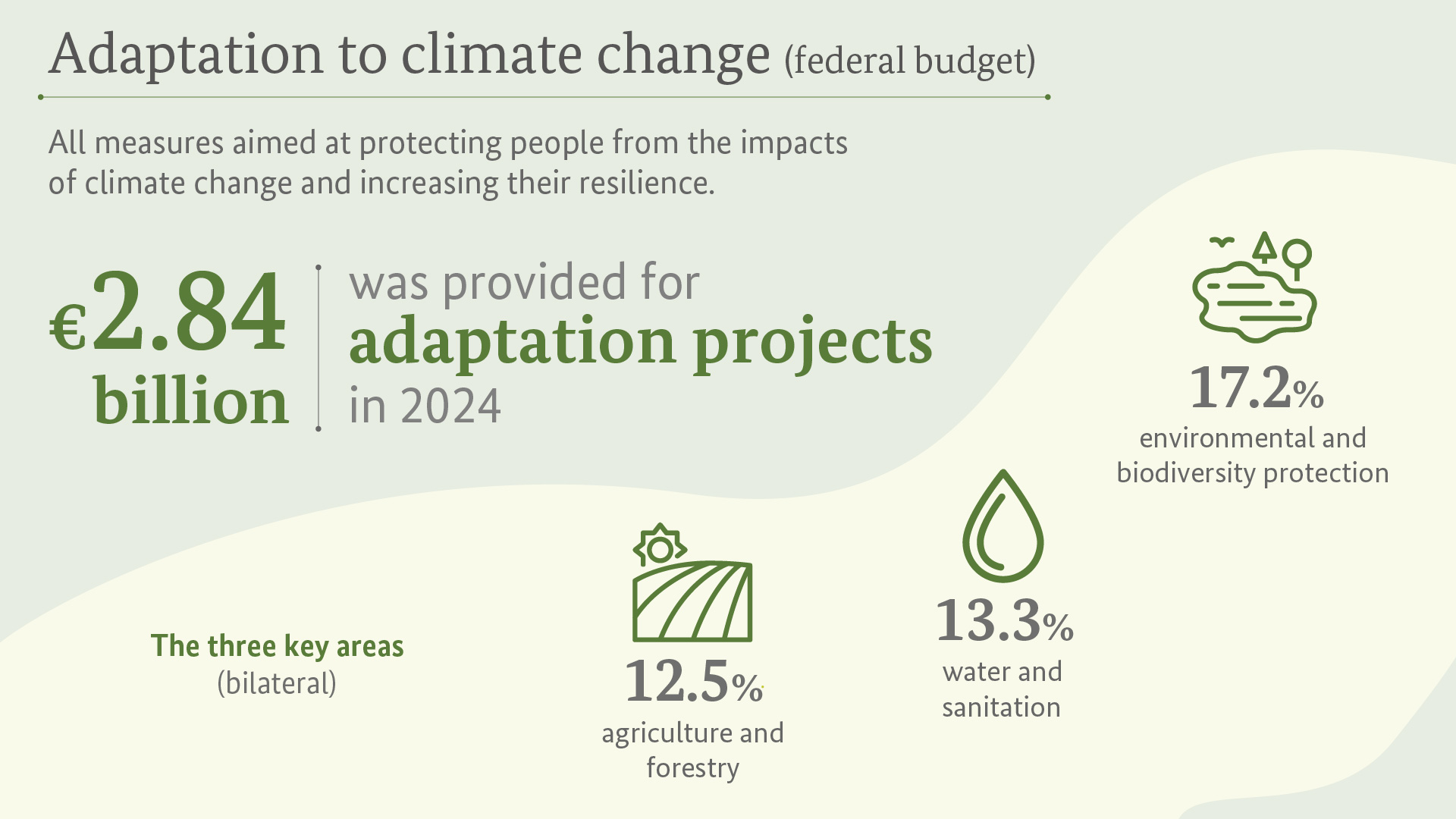

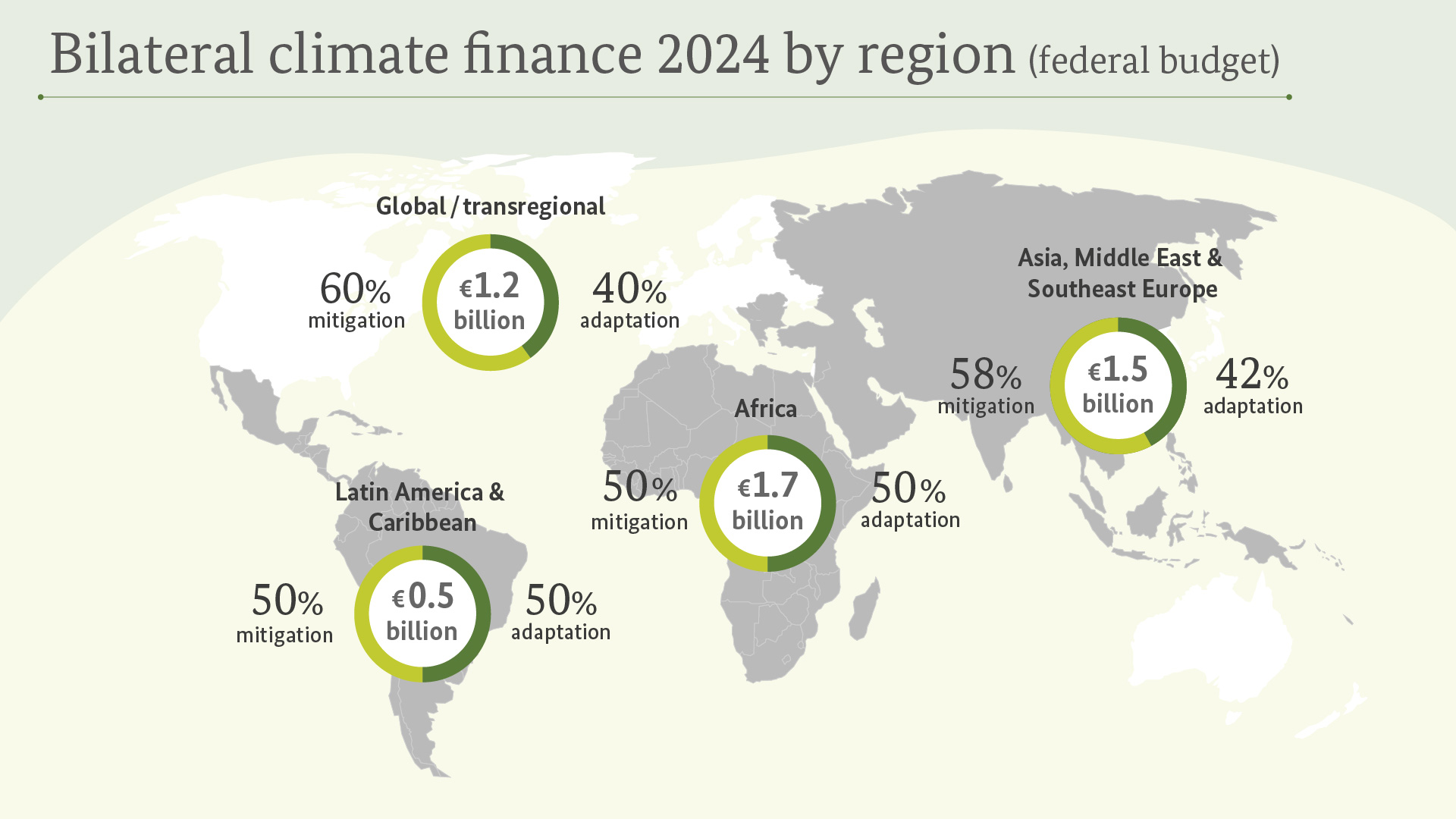

It is a declared goal of the German government that the provision of financial resources should aim to achieve a balance between adaptation and mitigation activities. This goal was largely attained in 2024. In that year, mitigation accounted for 54 per cent and adaptation for 46 per cent of the budget funds. These resources went towards climate projects in over 80 countries.

In its coalition agreement, the German government has reiterated that Germany remains committed to the internationally agreed climate goals. This includes increasing Germany's contribution to at least six billion euros per year by 2025 at the latest, thus honouring the commitment made by then Chancellor Angela Merkel at the 2021 G7 summit. After 2022, Germany again achieved this target.

German climate finance from public budget funds (2017-2024)

In addition to the funding provided from its federal budget, Germany also contributes via public loans. In 2024, a total of 4.57 billion euros was committed via KfW Development Bank and the Deutsche Investitions- und Entwicklungsgesellschaft (German Investment and Development Company – DEG) in the form of development loans, promotional loans, equity investments and other financing from capital market funds.

In addition, Germany successfully undertook targeted efforts to mobilise private climate finance, for instance through revolving credit lines for local (development) banks, investments in funds, and public-private partnerships (PPPs).

Climate finance 2024

Bilateral and regional activities

Climate finance goes both towards mitigation and adaptation activities. Some projects also contribute to the conservation of forests and biodiversity, for example under the REDD+ process. Moreover, the BMZ assists selected partner countries in their efforts to harness international market mechanisms under Article 6 of the Paris Agreement (External link) in such a way that financial incentives for emissions reductions are combined with tangible benefits for sustainable development.

Germany channels most of its climate finance through bilateral cooperation. The BMZ works with nearly all its partner countries on integrating climate change mitigation and adaptation into their national development strategies. In these efforts, Germany aligns its support with the priorities and initiatives of its partners and helps to strengthen their capacity to pursue their own climate goals.

An average of around 80 per cent of Germany's annual budget funding for climate finance comes from the BMZ's budget. Further resources are provided through the International Climate Initiative (IKI) (External link), which is implemented by the Federal Ministry for the Environment, Climate Action, Nature Conservation and Nuclear Safety (BMUKN) in close consultation with the BMZ. The Federal Ministry of Education and Research (BMBF) and the Federal Ministry of Agriculture, Food and Regional Identity (BMLEH) also contribute to Germany's climate finance.

Via the BMZ and the Federal Foreign Office, which is the lead agency for the international negotiations, Germany makes its development policy perspective heard in international climate negotiations. Its overarching goal is to advance climate action and sustainable development worldwide.

Multilateral activities

When it comes to effecting structural change on a large scale, multilateral and international organisations like the multilateral climate funds, the World Bank Group and the United Nations are important partners. They implement major programmes in developing countries and emerging economies and coordinate the inputs of various different donors. Multilateral institutions also often play a key role in policy dialogue at national and international level. To complement its bilateral activities, the BMZ therefore engages in ambitious multilateral cooperation in the climate sector.

Germany makes a major contribution to multilateral climate finance. The BMZ is one of the biggest supporters of the Green Climate Fund (GCF) (External link) and the Global Environment Facility (GEF) (External link). Germany is also a major donor to the specialised GEF funds such as the Least Developed Countries Fund (External link), the Special Climate Change Fund (External link) and the Adaptation Fund (External link), and to the Climate Investment Funds (CIF) (External link). In this field, the German government is a strong supporter of inter-fund cooperation. It actively pursues the interests and values that underlie Germany's development policy.

One key concern of Germany is the provision of support to its partners as they respond to climate-related loss and damage (External link).

The BMZ is working with the development banks to improve the enabling environment for effective climate policies. Reforms to the global financial system play a special role in this context. Multilateral and national development banks can take the lead in shifting international and local financial flows systematically towards low-emission and climate-resilient investment. That means ensuring that their whole range of activities take account of climate change and its consequences.

Among other things, the BMZ has successfully campaigned for the International Development Association (IDA) (External link), the World Bank's financing instrument for the poorest countries, to mainstream climate change mitigation and adaptation in its core business. Such structural change has a long-term impact – for the benefit of partner countries and also in the interests of global stability, fair markets and joint crisis prevention.

- Climate Finance Advisory Service (CFAS) (2024): Effectiveness of Climate Finance – How to Enhance the Impact Measurement External link

- Climate Finance Advisory Service (CFAS) (2024): Towards a Political Compromise on the NCQG Contributor Base External link

- Climate Finance Advisory Service (CFAS) (2023): MDBs’ partnerships with international climate funds | CFAS External link

- Climate Finance Advisory Service (CFAS) (2022): Process Proposal for Defining the New Collective Quantified Goal External link

- Germanwatch (2022): Mobilising climate adaptation investments from the private sector in developing countries External link

- Climate Finance Advisory Service (CFAS) (2021): Making finance flows consistent with the Paris Agreement: Opportunities and challenges concerning Article 2.1c External link

- Climate Finance Advisory Service (CFAS) (2020): Options for the post-2025 climate finance goal External link

As at: 29/09/2025