-

Completed event21.-24.05.2024, in personOECD Forum on Responsible Mineral Supply Chains

The OECD Forum on Responsible Mineral Supply Chains will take place in Paris from 21-24 May 2024. Agenda and registration can be found here (External link).

-

11.06.2024, onlineEvent series “responsible gold”

The next workshop as part of the event series “responsible gold” focuses on environmental issues in the context of gold mining. More information (External link).

Events in the Extractives Sector

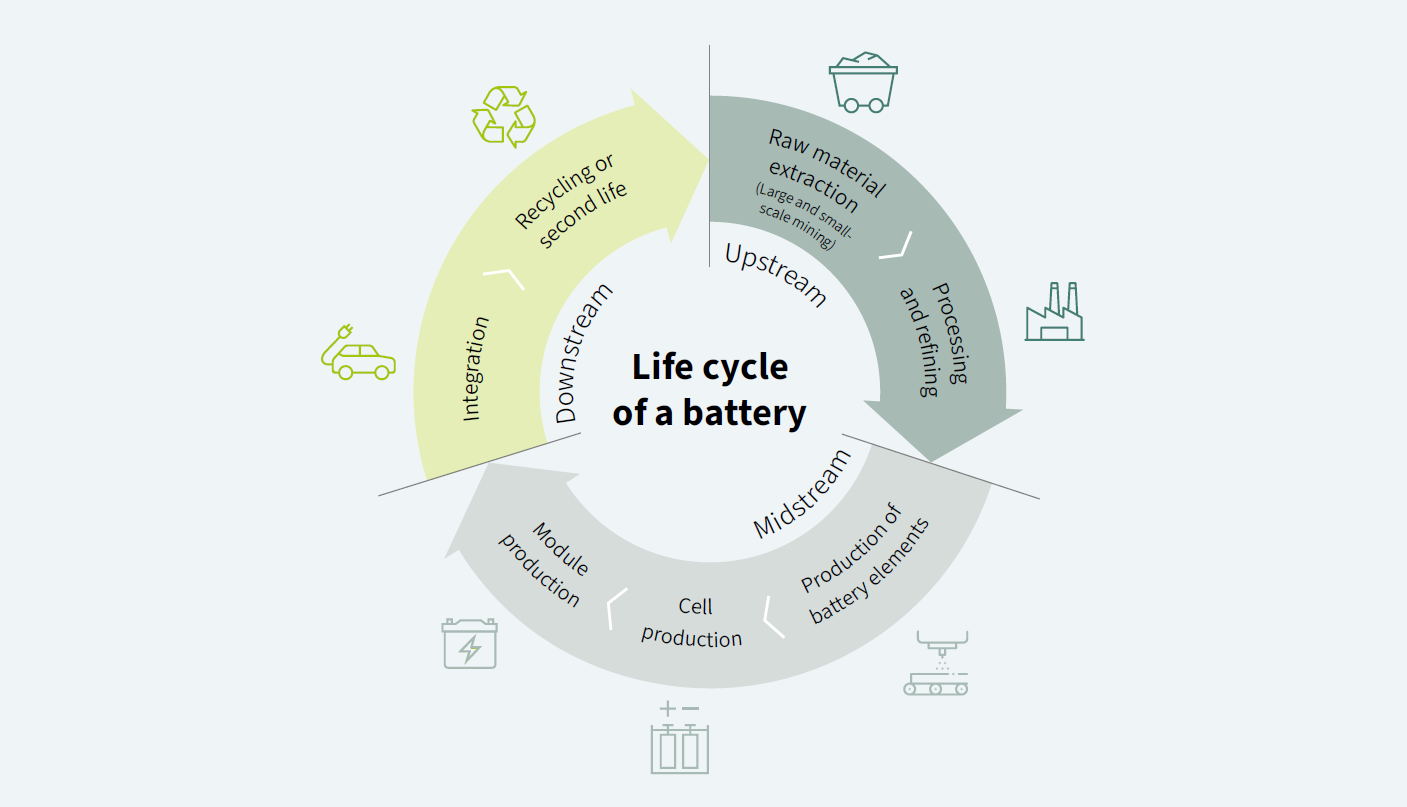

Responsible Mineral Supply Chains for the Just Transition

Who are we?

On behalf of the Federal Ministry for Economic Cooperation and Development (BMZ), the Sector Programme “Extractives and Development” is jointly implemented by the Federal Institute for Geosciences and Natural Resources (BGR) and the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ).

The Sector Programme “Extractives and Development” supports the BMZ in shaping the national and international development policy agenda in the extractive sector through its own impulses and innovations, and advises the BMZ continuously and comprehensively on economic and policy issues related to extractives.